Liquidity

Aggregator

Liquidity for brokers and cryptocurrency exchanges. Management of providers and control of high-quality order execution.

Contact Us

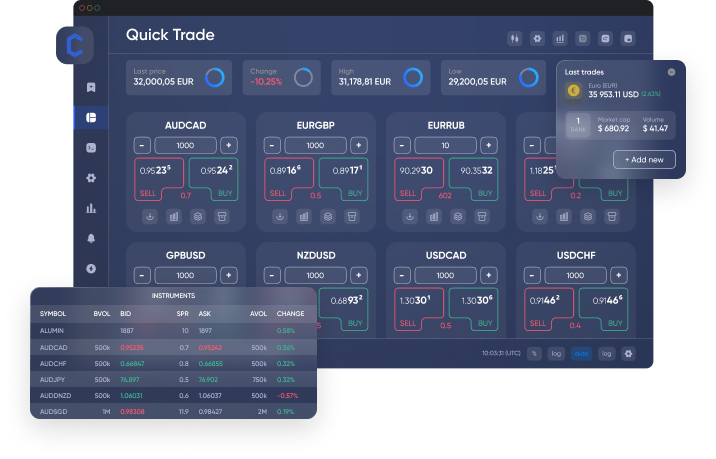

Aggregator

Software solution for aggregating the liquidity of financial assets from various external and internal sources

Bridge

Script for interaction between trading platforms, liquidity providers and the administrative module

Feeder

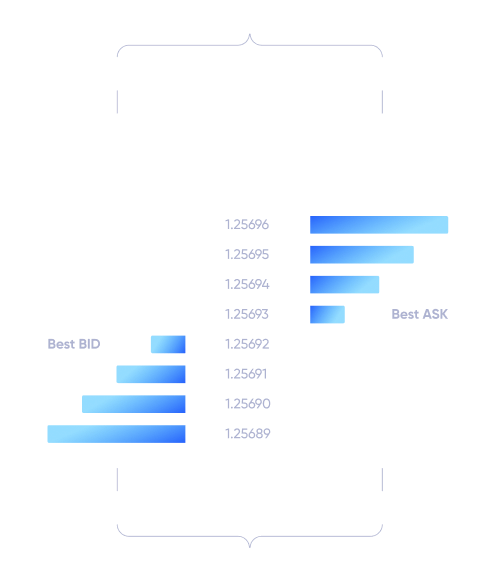

The component passes quotes through a system of customizable filters, forming a balanced depth of the market

Trading

Technologies

Liquidity is a flow of buying and selling operations of financial assets, that ensures fast and high–quality execution of client orders. With the help of liquidity, it is possible to overlap transactions while remaining an intermediary combining supply and demand.

Connect to providers and liquidity pools. Combine multiple data streams into a single ecosystem. Provide your traders with some of the best Bid and Ask prices from top financial counterparties.

Work with an unlimited number of prime brokers, crypto exchanges, ECNs, and other institutional partners. Any integrations will be performed under your request and in a short time.

Flexible Functions

and Parameters

Forex

Liquidity

Give your clients access to the global forex market, among which over-the-counter currency instruments, including spot, forwards, and options. Use a system of end-to-end execution (STP), or a hybrid model of distribution of client orders.

40+ connectors:

- Liquidity providers

- Prime Brokers

- ECNs and MTFs

- Banks

Turnkey Liquidity

| Hedge deposit | from $5000 |

| Commission | from $0,8 per lot |

| Spread | from 0,01 |

| Leverage | up to 1:200 |

| Currency pairs | 50+ |

| CFD | 600+ |

| Level | Tier 1 |

| API interfaces | FIX, REST, WebSocket |

Liquidity on

Exchange-Traded Assets

Gateway FIX/FAST

The FIX and FAST gateway system allows you to connect directly to exchanges, dark pools and clearing centers around the world. This is the most efficient way to place orders in the integrated trading environment.

Market Data

Get high-quality market data in real time using industry-standard financial information exchange protocols. Quotes, economic indicators, and other indicators via API.

Multi-Asset Execution

A single account and prime brokerage service from our partner. Depository, clearing and post-trading services for online brokers. Access to stocks, bonds, funds, futures, and other asset categories.

Any questions?

Contact us in any convenient way or use our feedback form. Our employees advise, share their experience, and help to find an acceptable solution for brokers.