We developed a fully custom cryptocurrency exchange for a licensed European fintech startup, delivering a secure, scalable, and modular trading platform tailored to both retail and institutional users. The platform supports spot, margin, and futures trading with real-time performance, enterprise-level wallet security, KYC/AML compliance, and a powerful admin panel. Our end-to-end development included frontend and backend architecture, trading engine, liquidity integration, mobile responsiveness, and robust DevOps infrastructure—ready to scale as the client grows.

Case Study: Full-Stack Crypto Exchange Platform (Under NDA)

- Client: Confidential (EU-Licensed Fintech Startup)

- Industry: Cryptocurrency Trading

- Region: Europe

- Duration: 8 Months

- Engagement Model: Full-Cycle Product Development

- Team Composition: Project Manager, Solution Architect, Backend Developers, Frontend Developers, DevOps Engineers, QA Engineers, UI/UX Designer

Project Overview

A European fintech startup approached us to build a full-featured cryptocurrency exchange platform from scratch. The client’s vision was to launch a modern, secure, and regulation-compliant exchange tailored for both beginner and professional traders. Key priorities included rapid go-to-market execution, adherence to EU financial regulations, seamless UX across devices, and the flexibility to support new token listings and trading products in the future.

Key Challenges

- Delivering a functional MVP under tight deadlines to attract initial users and investors.

- Implementing a multi-asset architecture with ultra-low latency trading performance.

- Building a secure custody system for digital assets, including hot/cold wallet setup.

- Integrating external KYC/AML providers while meeting EU compliance requirements.

- Ensuring a responsive and intuitive trading experience on both desktop and mobile.

- Designing scalable backend architecture to accommodate future growth and token additions.

Our Approach & Solution

We provided a comprehensive, full-cycle development service—from initial architecture to post-launch DevOps support. The result was a modular, high-performance cryptocurrency exchange tailored to the client’s unique business needs, technical goals, and compliance requirements.

Core Features Delivered

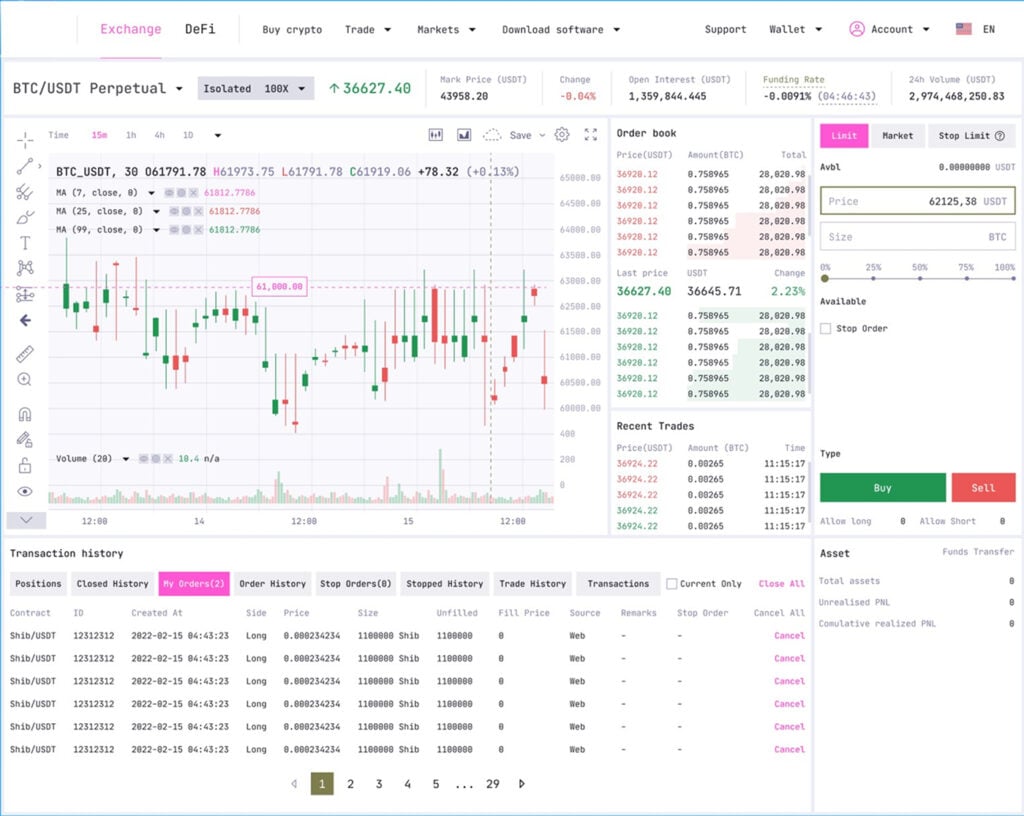

- Ultra-Fast Matching Engine for spot, margin, and futures markets

- Multi-Asset Support including BTC, ETH, USDT, fiat currencies, stablecoins, and tokenized assets

- Margin Trading with Risk Engine: Collateral logic, position management, liquidation algorithms

- Futures Trading Module: Cross and isolated margin modes, funding rate mechanics

- Integrated Custody Infrastructure: Hot/cold wallet management, multi-signature support

- KYC/AML Integration: External provider (e.g., Sumsub) for identity verification and compliance

- Custom Admin Dashboard: Role-based access, user management, transaction monitoring

- Liquidity Aggregation: Integration with external exchanges and market makers via API

- Responsive Web & Mobile Frontend: Advanced UI with TradingView integration, light/dark themes

- Enterprise-Grade Security Layer: 2FA, encryption, logging, session control, anomaly detection

Technology Stack

- Frontend: React.js, Next.js, Tailwind CSS

- Backend: Node.js, PostgreSQL, Redis

- DevOps & Infrastructure: AWS, Docker, Kubernetes, CI/CD Pipelines

- 3rd-Party Integrations: Chainalysis, Fireblocks, Sumsub, CoinGecko API, TradingView

Results & Impact

The delivered exchange went live with an MVP in just under 4 months and continued into full feature rollout by month 8. The platform successfully passed internal compliance audits and began onboarding early users within weeks of launch. With a modular codebase, scalable infrastructure, and a secure trading environment, the client is now positioned for future expansion, token listings, and integration with DeFi services.